Individual Health Insurance

Affordable Health Care

Health Insurance is not cheap.

Here's something you will love:

AlieraCare

An Economic Plan for the Family

With the rising cost of health insurance and the frustrations of trying to obtain the desired coverage in either the private sector or the Marketplace, Aliera Healthcare offers a refreshing alternative. Not a traditional health insurance, Aliera Healthcare offers an everyday plan that has broad coverage at reasonable prices. A refreshing option in today’s frustrating market.

The benefits of Aliera’s standard healthcare plans

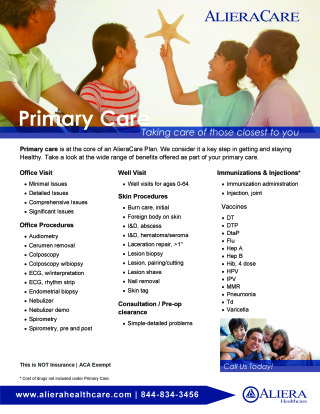

Aliera Healthcare’s affordable health insurance alternative—AlieraCare—offers low-cost health coverage for both individuals and families. This affordable individual health coverage provides individuals and families with immediate access to doctors through office visits, urgent care, and telemedicine.

Telemedicine allows members to reach a U.S. board-certified doctor 24/7 from the comfort of their home rather than having to brave the crowds when feeling ill. Members can speak with a physician on the phone or by video and can receive prescriptions and follow-up recommendations without having to take time off of work or wait in crowded waiting rooms. With this affordable health coverage, telemedicine is 100% covered by the plan.

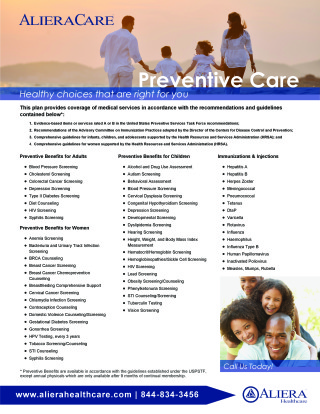

Preventive care is also covered with zero out-of-pocket expenses and no member responsible shared amount (MRSA) for in-network providers and labs. Flu shots, regular annual screenings, and immunizations are all covered with this low-cost individual healthcare insurance. An average savings of 55% on every prescription is seen by Aliera members.

Aliera Healthcare’s affordable individual health plans include medical coverage for primary care physician visits, pharmaceuticals, basic eye and hearing examines, both in- and out-patient procedures, extended hospitalizations, urgent care needs, labs, and diagnostic procedures. It’s an all-inclusive, affordable health coverage option. Even people with preexisting conditions can get good coverage—reaching a doctor whenever they need through telemedicine.

The difference between standard healthcare and major medical:

Major medical insurance must meet the minimum requirements of the Affordable Care Act (ACA). These requirements include preventive care, prescription drug coverage, emergency services, and hospitalization and the costs that come with it. Although Aliera’s standard healthcare coverage is not insurance, it does offer all of the above services but is exempt from the individual responsibility requirements of the Patient Protection and Affordable Care Act (ACA) by way of its support from a healthcare sharing ministry. Simply put, its members aren’t tied to the insurance mandates outlined within the ACA.

The standard healthcare plan’s ideal candidate

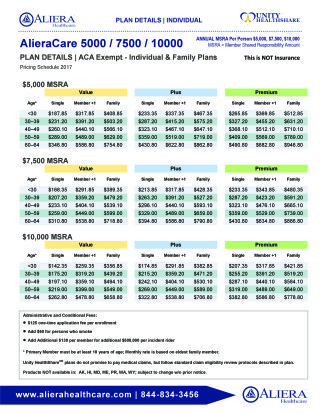

Aliera’s standard healthcare coverage is ideal for individuals and families who want both physician and hospitalization coverage at lower costs. With premium costs for an individual starting at just $187.85 per month, what is saved on premiums can be set aside to help cover the higher MSRA, which works like a deductible in traditional insurance. Members can also choose how high or low they want the MSRA to be with three plans setting the MSRA to $5000, $7500, or $10,000.

Known in the industry as everyday health plans or low-cost comprehensive healthcare, Aliera’s standard health plan option is paving the way to a new style of healthcare. For people looking for a company that cares about its members, contact Aliera Healthcare today. Taking control of health insurance premiums and coverage can be really simple.

*All of the Aliera Healthcare plans for individuals and families are supported and are part of a healthcare sharing ministry, and thus members are exempt from any ACA penalties

AlieraCare

Aliera's standard healthcare plan, AlieraCare, is recommended for individuals and families who are primarily healthy and whose main concern is preventive services and basic medical needs, as well as coverage for a catastrophic care event.

AlieraCare Plans

Aliera has combined the Aliera 'MEC' solution with the Unity HealthShare Hospitalization. This two-part offering provides basic care and covers catastrophic hospitalization, with the ability to choose from $5,000 to $10,000 MSRA.

AlieraCare Plans

Aliera has combined the Aliera 'MEC' solution with the Unity HealthShare Hospitalization. This two-part offering provides basic care and covers catastrophic hospitalization, with the ability to choose from $5,000 to $10,000 MSRA.

Or call to talk to Susan

570 265-3182

Set Up Your Free Consulation Today!

Susan Salzman will help you navigate through the confusing maze of insurance. She'll shop the market for the best deals, and help you decide on the best product for your needs, at no cost to you.